Bitcoin vs Altcoins Which Is Right for Businesses

When considering entering the cryptocurrency market as a business, one key question often arises: “Should I invest in Bitcoin or explore Altcoins?” The crypto landscape is vast and can feel overwhelming. While Bitcoin frequently dominates the spotlight, Altcoins—short for alternative coins—have been steadily gaining traction. Both offer unique advantages, drawbacks, and investment potential.

This blog takes an in-depth look at Bitcoin versus Altcoins, helping you determine which option aligns best with your business’s investment strategy. By the end, you’ll have a clearer understanding of how these digital assets differ and which might best support your financial goals.

What Sets Bitcoin Apart

Bitcoin, often referred to as digital gold, was the first cryptocurrency introduced to the world in 2009 by an unknown entity, Satoshi Nakamoto. It immediately revolutionized the financial world as a decentralized currency, free from traditional banks or governing authorities.

Main Features of Bitcoin

- Market Leadership

Bitcoin occupies the lion’s share of the cryptocurrency market cap, making it the most stable and widely adopted digital currency.

- Store of Value

Often likened to gold, Bitcoin functions as a store of value. This is due to its limited supply of 21 million coins, which adds to its scarcity and long-term value.

- Robust Security

Bitcoin operates on a highly secure blockchain, making it a haven for investors seeking transparency and safety.

- Universal Recognition

Bitcoin has universal acceptance in the world of digital transactions, with a wide network of businesses and platforms already supporting it.

These qualities make Bitcoin the favorite for many businesses looking for a secure and risk-averse entry point into cryptocurrency investing.

Key Drawbacks of Bitcoin for Businesses

- High Cost of Entry

Bitcoin’s current price point can deter smaller businesses or those looking to diversify their investment portfolio.

- Scalability Issues

Bitcoin’s transaction speeds are slower and more costly compared to newer Altcoin blockchains.

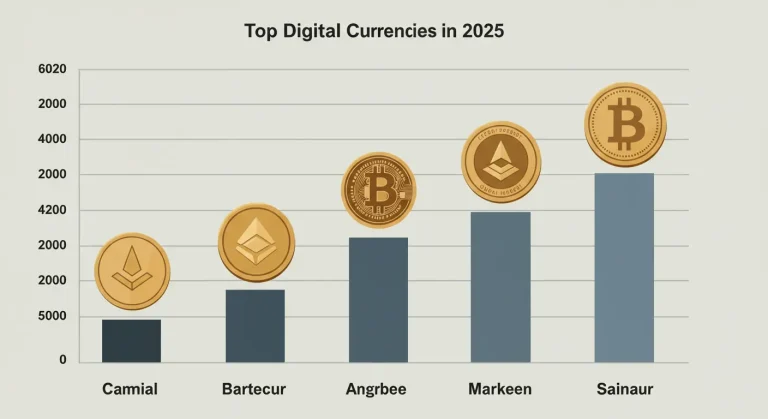

Understanding Altcoins

Altcoins refers to any cryptocurrency other than Bitcoin. These include Ethereum, Binance Coin, Ripple, Cardano, and thousands more. They serve diverse purposes, offering businesses flexibility in selecting assets to align with investment objectives.

Main Features of Altcoins

- Innovation and Advancements

Altcoins like Ethereum introduced Smart Contracts, while other coins like Cardano and Solana focus on scalability and speed. Innovation thrives here.

- Affordability

Altcoins are generally more affordable than Bitcoin, opening opportunities for businesses with smaller budgets.

- Specialization

Many Altcoins are tailored for specific industries or markets. For instance, Ripple is heavily used in the banking sector for cross-border payments.

Risks of Altcoins for Businesses

- Volatility

Altcoins typically experience higher volatility compared to Bitcoin, leading to greater risk for investors.

- Market Fragmentation

With over 20,000 Altcoins available, distinguishing promising assets from short-lived gimmicks requires careful research.

- Lower Adoption Rates

Some Altcoins are not as widely recognized or adopted, limiting their usability for businesses.

Bitcoin or Altcoins Which Fits Your Business Goals

The choice between Bitcoin and Altcoins depends largely on your specific business needs, risk tolerance, and investment strategy.

When Bitcoin Is the Better Option

- Your business values stability and is willing to prioritize long-term growth over short-term gains.

- You want an asset with strong global recognition and credibility.

- Your budget permits an investment in a high-value cryptocurrency.

When Altcoins May Be a Smarter Choice

- Your business seeks high-growth opportunities and doesn’t mind facing short-term volatility.

- You’re exploring niche markets or industries where specialized Altcoins provide strategic value.

- You want to diversify your cryptocurrency investments with affordable options.

Diversification A Balanced Approach

A compelling case can be made for maintaining a diverse portfolio that includes both Bitcoin and Altcoins. Diversification spreads the risk and leverages the unique strengths of different cryptocurrencies.

For example, a business could allocate 60% of its crypto investments in Bitcoin for stability and 40% in carefully chosen high-potential Altcoins for growth opportunities.

Tips for Making Cryptocurrency Investment Decisions

Before venturing into digital currencies, consider these strategic tips for businesses:

- Understand the Market

Educate yourself about cryptocurrencies and blockchain technology. Regularly track trends and updates in the crypto world.

- Set Specific Goals

Identify what you aim to achieve with crypto investments, be it long-term wealth preservation or short-term financial gain.

- Evaluate Risks

Assess your risk tolerance and only invest what your business can afford to lose. Volatility is inherent in the cryptocurrency market.

- Start Small and Scale Up

Begin with modest investments to gauge the impact of cryptocurrency on your business finances. Gradually scale up as you gain confidence.

Technological Implications for Businesses

For businesses, adopting cryptocurrencies isn’t just about investment; it’s also a step toward future-proofing operations. Many organizations now accept Bitcoin and Altcoins for payments, enjoying reduced transaction costs and faster processing times compared to traditional methods.

Decentralized Finance (DeFi) solutions, predominantly driven by Altcoins like Ethereum, are further unlocking opportunities such as peer-to-peer lending, decentralized exchanges, and yield farming. Businesses looking to stay competitive should consider how blockchain technologies can integrate into their operations.

Moving Forward in the World of Crypto

Cryptocurrencies, whether Bitcoin or Altcoins, offer immense opportunities for businesses willing to adapt and evolve. Bitcoin provides stability and credibility, serving as digital gold for those seeking minimal risk. Meanwhile, Altcoins offer flexibility, innovation, and growth potential.

Ultimately, the right choice depends on your specific goals, industry trends, and appetite for risk. The key is to arm yourself with the right knowledge and strategic mindset before taking the leap.