Digital currencies like Bitcoin, Ethereum, and others have transformed the investment landscape, capturing the interest of both novice investors and seasoned financial experts. But are they the right choice for your portfolio? This blog takes a deep dive into the world of digital currencies, exploring the risks, potential rewards, and smart strategies for navigating this complex yet exciting market.

While investing in digital currencies holds great promise, it’s crucial to approach it with caution and clear awareness. By the end of this blog, you’ll have a solid understanding of this rapidly evolving technology and how to engage with it responsibly.

What Is Digital Currency

Digital currency, often referred to as cryptocurrency, is a type of decentralized digital asset that uses blockchain technology to secure and track transactions. Unlike traditional currencies, digital currencies function without a central authority, such as a government or bank. Bitcoin, the first cryptocurrency, was launched in 2009, but today, there are thousands of digital currencies used in various industries.

Interest in digital currency has grown significantly over the last decade. The promise of decentralization, financial inclusion, and above-average returns has made it a favorite among speculative investors. But with great potential comes great complexity, particularly for those who are new to this investment landscape.

Understanding the Risks of Digital Currency

Before you start investing in digital currency, it’s vital to thoroughly understand the risks involved.

Volatility in the Market

One of the most prominent risks associated with digital currency is price volatility. Drastic price swings can occur within short periods, making it common for digital currency values to rise or fall by double digits within hours. For example:

- Bitcoin soared from $5,000 in March 2020 to over $60,000 in October 2021, before plunging back to $30,000 in 2022.

- Ethereum’s rapid price fluctuations have made it equally unpredictable for short-term investments.

This volatility can be unsettling, especially if you are looking for safer, low-risk investments.

Security and Cyber Risks

The digital nature of cryptocurrencies makes them susceptible to hacking and theft. Although blockchain itself is secure, online wallets and exchanges where these currencies are stored are not immune to attacks. Hacks like the $600 million Poly Network heist highlight the importance of safeguarding digital assets with robust cybersecurity practices.

Regulatory Uncertainty

Another challenge investors face is the lack of consistent regulations across global markets. Countries like China have banned cryptocurrency trading altogether, while others, like the U.S., are working to implement clearer frameworks. Regulatory shifts can impact market values, leaving investors exposed to legal and financial uncertainties.

Potential Rewards of Investing in Digital Currency

Despite the risks, digital currency investments can offer attractive rewards for those willing to explore this new frontier responsibly.

High Potential Returns

Unlike traditional investments, cryptocurrencies have provided extraordinary returns for early adopters. For example:

- A $1,000 investment in Bitcoin in 2010 would have turned into over $50 million by 2021.

- Altcoins (non-Bitcoin currencies) also offer high growth potential, with some smaller coins experiencing 1,000% increases in value within months.

While such returns are alluring, remember that past growth does not guarantee future success.

Diversification of Your Investment Portfolio

Adding cryptocurrency to your traditional stock-and-bond portfolio can improve diversification. Cryptocurrencies often have unique market trends, making them an asset class that could thrive when others are underperforming. This diversification may help reduce overall portfolio risk if balanced wisely.

Technological Promise

Beyond pure financial benefits, digital currencies represent exciting technological advancements. Blockchain technology, the foundation of cryptocurrencies, is being applied in industries ranging from healthcare to supply chain management. Investing in these assets often means supporting groundbreaking innovations that could shape the future.

Practical Investment Strategies for Digital Currency

Success in digital currency investment lies not only in spotting opportunities but also in adhering to smart strategies.

Conduct Thorough Research

Not all digital currencies are created equal. Before investing, take time to research currencies, their technologies, and their communities. Key things to consider include:

- Market Cap (the total value of all circulating coins)

- Utility (what the coin is used for)

- Development Team (who is behind the project)

Platforms like CoinMarketCap and Whitepapers from various cryptocurrencies are excellent resources for research.

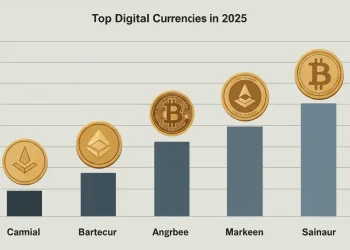

Diversify Your Investments

One strategy to manage the inherent risks of digital currency is diversification. Instead of investing solely in one cryptocurrency, spread your investments across several coins. Choose a mix of established cryptocurrencies (like Bitcoin) along with smaller, emerging currencies for a balance of risk and potential return.

Take a Long-Term View

Given the volatility of the digital currency market, adopting a long-term investment perspective can be advantageous. Instead of reacting to daily price fluctuations, focus on the underlying value of the technology and its potential over time. Patience can often pay off when navigating the ups and downs of crypto markets.

Preparing for the Future of Digital Money

Digital currencies are redefining the global financial system, but their role in the mainstream economy is still evolving. While risks such as regulatory uncertainty and extreme volatility persist, the potential for high rewards and technological disruption make them an enticing option for forward-thinking investors.

Key Takeaways for Aspiring Investors

- Understand the unique value and risks of each cryptocurrency.

- Diversify your investments to balance potential returns with risk.

- Stay up-to-date with regulatory developments and adopt a long-term strategy.

If you’re considering stepping into the world of digital currency, start building your knowledge today. Research different cryptocurrencies, recognize market trends, and develop strategies to minimize risks. Remember, the key to successful investing is preparation and informed decision-making.

Whether you’re curious about building financial independence or exploring the cutting edge of technology, investing in digital currency invites you to become part of a financial revolution.