Bitcoin is more than just a currency—it represents a fundamental shift in how we perceive and use money. Launched in 2009, Bitcoin became the world’s first decentralized digital currency. Unlike traditional money controlled by banks and governments, Bitcoin runs on a peer-to-peer network, allowing users to manage their financial transactions directly.

Over the past decade, Bitcoin has evolved from a niche digital experiment into a global financial asset. Its journey is one of innovation, disruption, and resilience, capturing the attention of millions worldwide. This blog delves into Bitcoin’s history, technology, market impact, and future, exploring how it has earned the nickname “digital gold.”

A Brief History of Bitcoin

The story of Bitcoin began in 2008 when an anonymous figure or group known as Satoshi Nakamoto published a whitepaper titled “Bitcoin A Peer-to-Peer Electronic Cash System.” The document outlined a vision for a new type of digital currency that could be sent directly from one party to another without the need for intermediaries like banks.

Bitcoin officially launched in January 2009 when Nakamoto mined the first block, known as the Genesis Block. At the time, the idea of a digital currency without any central authority was revolutionary. Early adopters, including developers and cryptography enthusiasts, were drawn to Bitcoin’s potential to disrupt traditional financial systems.

The first real-world Bitcoin transaction occurred in 2010 when a programmer famously paid 10,000 BTC for two pizzas. At the time, Bitcoin was virtually worthless, but this transaction marked the start of its use as a medium of exchange. Fast forward to today, and that 10,000 BTC would be worth hundreds of millions of dollars, underscoring Bitcoin’s meteoric rise.

The Technology Behind Bitcoin

At the heart of Bitcoin is blockchain technology, a decentralized and transparent ledger that records all transactions. This technology ensures that Bitcoin is secure, tamper-proof, and immune to fraudulent activities like double-spending.

How Blockchain Works

- Blocks: Transactions are grouped into blocks, which are then added to the blockchain in sequential order.

- Decentralization: Instead of being stored in a central location, the blockchain is distributed across a network of computers (known as nodes). Each node has a complete copy of the blockchain.

- Validation: Transactions are verified by miners using a process called Proof of Work (PoW). This involves solving complex mathematical puzzles to add a new block to the chain.

- Immutability: Once a block is added, it cannot be altered without changing all subsequent blocks, making the blockchain highly secure.

Bitcoin’s blockchain was the first of its kind, and it has since inspired thousands of cryptocurrencies and blockchain-based projects. Its decentralized nature eliminates the need for trust in a single authority, making it a game-changer in the world of finance.

The Impact of Bitcoin on the Financial Market

Bitcoin’s influence extends far beyond its role as a digital currency. It has reshaped the financial landscape in several profound ways:

1. A New Asset Class

Bitcoin has established itself as a legitimate asset class, often referred to as “digital gold.” Investors see it as a store of value and a hedge against inflation, similar to traditional gold. Its limited supply of 21 million coins adds to its appeal as a scarce and valuable resource.

2. Decentralized Finance (DeFi)

Bitcoin paved the way for the broader crypto ecosystem, including decentralized finance. DeFi projects leverage blockchain technology to offer financial services like lending, borrowing, and trading, all without the need for intermediaries.

3. Institutional Adoption

Major companies and financial institutions have begun to recognize Bitcoin’s potential. Firms like Tesla, MicroStrategy, and Square have added Bitcoin to their balance sheets, signaling growing acceptance within mainstream finance.

4. Challenges for Traditional Banks

Bitcoin challenges the traditional banking system by offering faster, cheaper, and borderless transactions. However, its rise has also prompted banks to explore digital currencies and blockchain technologies to remain competitive.

5. Volatility and Speculation

While Bitcoin’s potential is undeniable, its price volatility has made it a target for speculation. This has led some critics to view it as a risky investment rather than a stable currency.

The Future of Bitcoin

As Bitcoin enters its second decade, its future is both exciting and uncertain. Here are some key areas to watch:

1. Regulation

Governments worldwide are grappling with how to regulate Bitcoin and other cryptocurrencies. While regulation could add legitimacy and stability, overly strict policies might stifle innovation.

2. Scalability

Bitcoin’s scalability remains a significant challenge. The network can currently process only a limited number of transactions per second, leading to delays and high fees during periods of high demand. Solutions like the Lightning Network aim to address this issue by enabling faster and cheaper transactions.

3. Adoption

Mass adoption is crucial for Bitcoin to fulfill its potential as a global currency. While awareness has grown, some barriers, such as user-friendliness and accessibility, still need to be addressed.

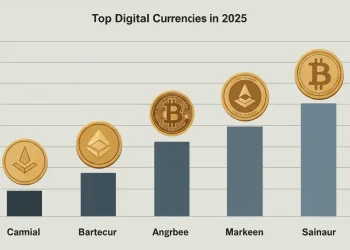

4. Competition

Bitcoin faces competition from thousands of other cryptocurrencies, some of which offer advanced features and capabilities. However, Bitcoin’s first-mover advantage and robust network effect continue to give it an edge.

5. Environmental Concerns

Bitcoin mining consumes significant energy, leading to criticism about its environmental impact. Efforts to transition to renewable energy sources and explore alternative consensus mechanisms could address these concerns.

Why Bitcoin Matters

Bitcoin’s rise is a testament to the power of innovation and the human desire for freedom and autonomy. It has redefined the way we think about money, trust, and value in the digital age. While challenges remain, Bitcoin’s resilience and adaptability suggest that it will continue to play a pivotal role in the future of finance.